A debt-to-equity ratio of 1.5 shows that the company uses slightly more debt than equity to stimulate growth. For every dollar in shareholders’ equity, the company owes $1.50 to creditors. Your company owes a total of $350,000 in bank loan repayments, investor payments, etc. It is also worth noting that, some industries or sectors like utilities or regulated industries have a lower risk and thus have a lower debt-to-equity ratio. But that doesn’t mean they are not taking advantage of the leverage, it just means that the leverage is not suitable for them and they have other ways to generate profits.

- The D/E ratio is a powerful indicator of a company’s financial stability and risk profile.

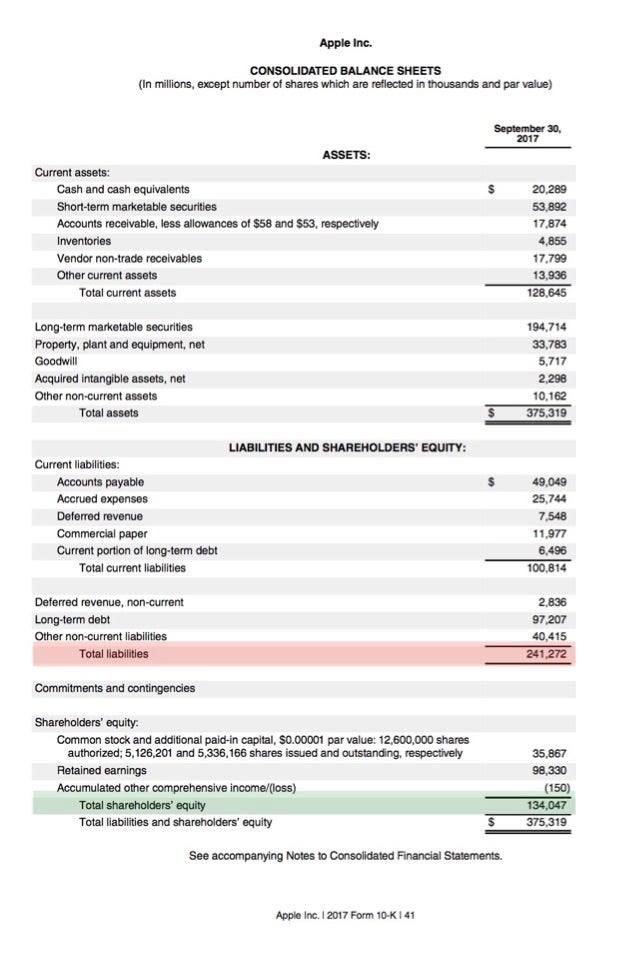

- Put another way, if a company was liquidated and all of its debts were paid off, the remaining cash would be the total shareholders’ equity.

- Reducing your debt-to-equity ratio involves the basic things you’re anticipating.

- Quick assets are those most liquid current assets that can quickly be converted into cash.

- All of our content is based on objective analysis, and the opinions are our own.

Example D/E ratio calculation

A debt ratio of .5 means that there are half as many liabilities than there is equity. In other words, the assets of the company are funded 2-to-1 by investors to creditors. This means that investors own 66.6 cents of every dollar of company assets while creditors only own 33.3 cents on the dollar. It suggests that a company relies heavily on borrowing to fund its operations, often due to insufficient internal finances. Essentially, the company is leveraging debt financing because its available capital is inadequate. A higher ratio suggests that a company is more reliant on debt, which may increase the risk of insolvency during periods of economic downturn.

Company

There is no universally agreed upon “ideal” D/E ratio, though generally, investors want it to be 2 or lower. Banks also tend to have a lot of fixed assets in the form of nationwide branch locations. The D/E ratio is much more meaningful when examined in context alongside other factors. Therefore, the overarching limitation is that ratio is not a one-and-done metric. As you can see from the above example, it’s difficult to determine whether a D/E ratio is “good” without looking at it in context. It’s clear that Restoration Hardware relies on debt to fund its operations to a much greater extent than Ethan Allen, though this is not necessarily a bad thing.

What Industries Have High D/E Ratios?

As a result, borrowing that seemed prudent at first can prove unprofitable later under different circumstances. A low debt to equity ratio means a company is in a better position to meet its current financial obligations, even in the event of a decline in business. This in turn makes the company more attractive to investors and lenders, making it easier for the company to raise money when needed. However, a debt to equity ratio that is too low shows that the company is not taking advantage of debt, which means it is limiting its growth. This is because ideal debt to equity ratios will vary from one industry to another.

For instance, in capital intensive industries like manufacturing, debt financing is almost always necessary to help a business grow and generate more profits. In such industries, a high debt to equity ratio is not a cause for concern. The debt-to-equity ratio is calculated by dividing a company’s total debt by its total equity. By learning to calculate and interpret this ratio, and by considering the industry context and the company’s financial approach, you equip yourself to make smarter financial decisions.

In most cases, this would be considered a sign of high risk and an incentive to seek bankruptcy protection. Business owners use a variety of software to track D/E ratios and other financial metrics. Microsoft Excel provides a balance sheet template that automatically calculates financial ratios such as the D/E ratio and the debt ratio. If a company’s debt to equity ratio is 1.5, this means that for every $1 of equity, the company has $1.50 of debt.

If a company’s D/E ratio is too high, it may be considered a high-risk investment because the company will have to use more of its future earnings to pay off its debts. For example, asset-heavy industries such as utilities and transportation tend to have higher D/E ratios because their business models require more debt to finance their large capital expenditures. Tesla had total liabilities of $30,548,000 and total shareholders’ equity of $30,189,000. Interest payments on debt are tax-deductible, which means that the company can reduce its taxable income by deducting the interest expense from its operating income.

This comparison can inform strategic decisions regarding financing and growth. This ratio indicates how much debt a company is using business accounting systems to finance its assets compared to equity. A high ratio may suggest higher financial risk, while a low ratio indicates less risk.

Ultimately, businesses must strike an appropriate balance within their industry between financing with debt and financing with equity. In some cases, creditors limit the debt-to-equity ratio a company can have as part of their lending agreement. Such an agreement prevents the borrower from taking on too much new debt, which could limit the original creditor’s ability to collect.