The payment periods are show in the top columns of the salary table and the various tax and payroll deductions are illustrated in each row. An individual who receives $ 33,320.50 net salary after taxes is paid $ 39,000.00 salary per year after deducting State Tax, Federal Tax, Medicare and Social Security. Let’s look at how to calculate the payroll deductions in the US. We’ve heard your feedback and are excited to announce that all your favorite Salary and Tax calculators are now available as dedicated apps for each State.

Federal Paycheck Calculator

It is worth noting that you can print or email this $ 39,000.00 salary example for later reference. There is a lot of detailed information which is worth reading and using as a reference, particularly if you file your own tax return without using a tax return software provider and/or accountant. You can also add-on communications tools such as a custom church website, custom church app, text and email messaging, church management software, and more.

Standard deduction

Use this free income tax calculator to project your 2024 federal tax bill or refund. If your employer calculates you monthly salary in this way, the below calculator illustrates the amounts you should expect to pay in Federal Tax, State Tax, Medicare, Social Security and so on. The Tax and Take home example below for an annual salary of $ 39,000.00 is basically like a line by line payslip example. This income tax calculation for an individual earning a 39,000.00 salary per year. The calculations illustrate the standard Federal Tax, State Tax, Social Security and Medicare paid during the year (assuming no changes to salary or circumstance). It is important to make the distinction between bi-weekly and semi-monthly, even though they may seem similar at first glance.

$42,000 Car Loan Monthly Payment and Interest Rate

If it turns out that your tax withholding, payments, or any credits you qualify for did not cover your liability, you may need to pay the rest at tax time. If you work for yourself, you need to pay the self-employment tax, which is equal to both the employee and employer portions of the FICA taxes (15.3% total). Luckily, when you file your taxes, there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay. The result is that the FICA taxes you pay are still only 6.2% for Social Security and 1.45% for Medicare. One way to manage your tax bill is by adjusting your withholdings. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven’t had enough withheld to cover your tax liability for the year.

- You can select your filing status, how often you are paid (so you can calculate how much your annual salary is based on your hourly rate etc.), and change between tax years as required.

- Really easy to get started, this platform is MADE for giving, unlike PayPal so we were relieved to find an alternative that was superior!

- You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage.

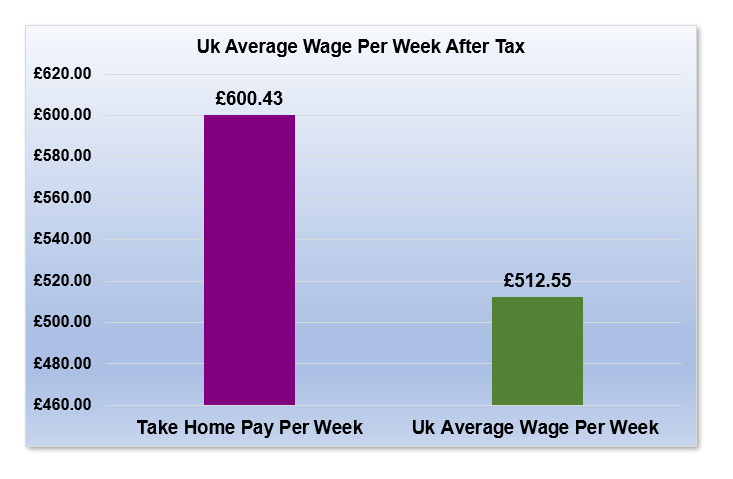

How to Increase a Take Home Paycheck

You can select your filing status, how often you are paid (so you can calculate how much your annual salary is based on your hourly rate etc.), and change between tax years as required. This is useful for quickly reviewing different salaries and how changes to income affect your Federal income tax calculations, State Income tax calculations and Medicare etc. Subtract how to set up direct deposit for employees your gross income with income taxes (federal, state, local) and payroll taxes (FICA, state insurance). You might need to minus deductions (401k, dental, etc) and additional withholdings. Use our free online paycheck calculator for a more precise estimate. When you start a new job or get a raise, you’ll agree to either an hourly wage or an annual salary.

How to calculate paycheck from salary?

Also known as ‘paycheck tax’ or ‘payroll tax’, these taxes are taken from your paycheck directly. Like federal tax liability, there are a few substeps to work out your state tax liability. There is an additional tax (surprise!) before the final step.

Federal taxes are progressive (higher rates on higher income levels). At the same time, states have an advanced tax system or a flat tax rate on all income. The money for these accounts comes out of your wages after income tax has already been applied. If you are early in your career or expect your income level to be higher in the future, this kind of account could save you on taxes in the long run.

The US tax system is also fairly complex, with different rules and rates applying to different types of income. You need to understand which tax bracket you belong to based on your taxable income and filing status. Tend to do so because their deductions add up to more than the standard deduction, saving them money.

Enter your gross income and filing status, and we’ll estimate your income after taxes are deducted. We are biased and we think we have the best paycheck calculator 😀 Our calculator is always kept up-to-date with the latest tax rates. It works for salary and hourly jobs, as well as self-employed people. There is also an option to spread your pay out over 12 months. If you live in a state or city with income taxes, those taxes will also affect your take-home pay. Just like with your federal income taxes, your employer will withhold part of each of your paychecks to cover state and local taxes.